Decentralised Autonomous Organisations (DAOs) are one of the most anticipated applications of blockchain technology. After all, this is the first time in history we homo sapiens had the means to coordinate in a trustless and anonymous way to make collective decisions for a certain cause.

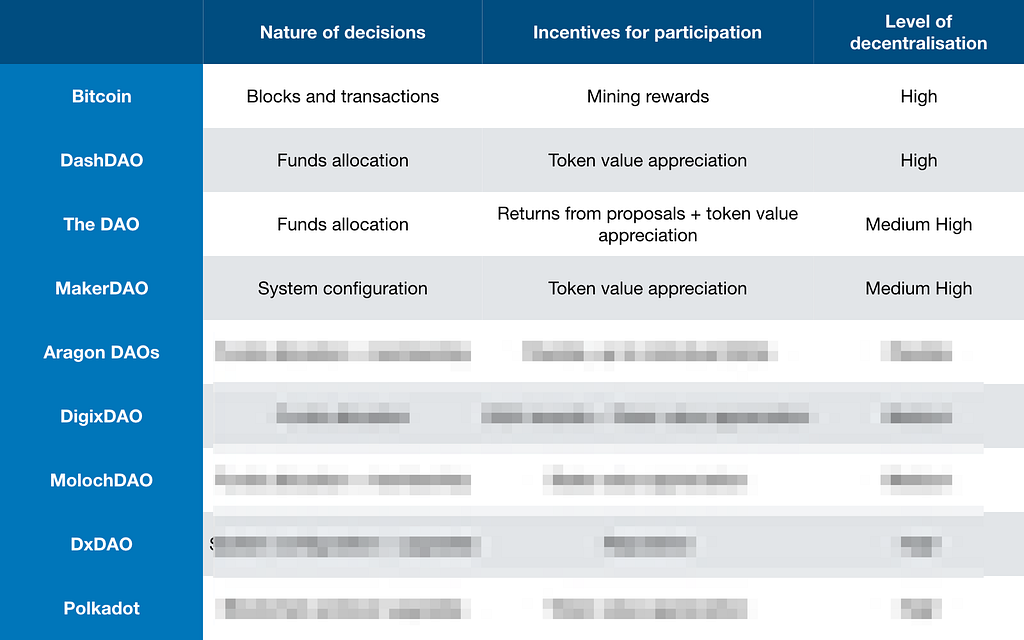

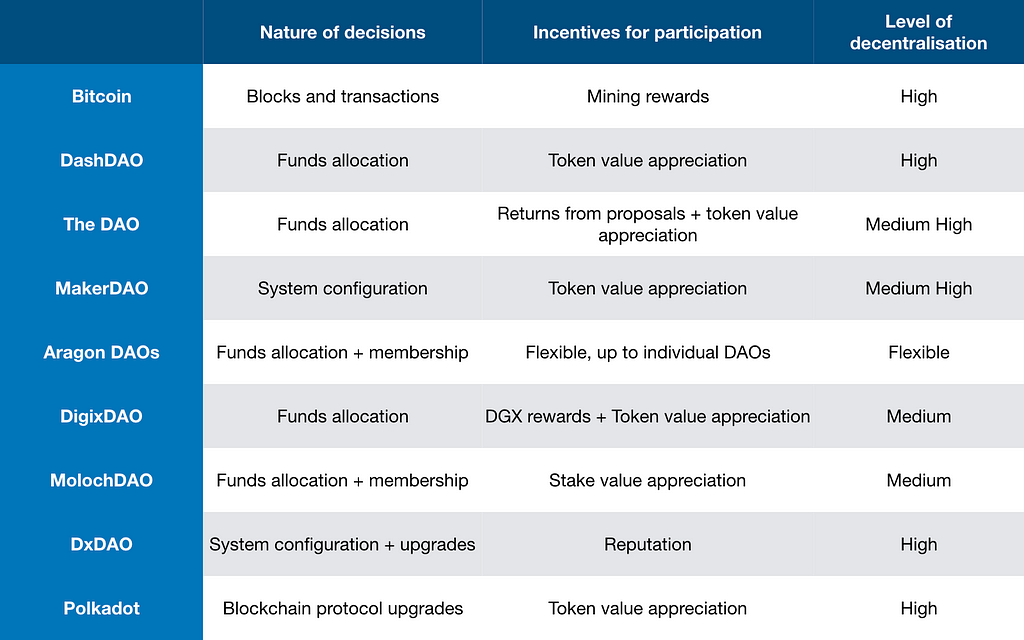

In this article, I will attempt to take you on a walk (be prepared, it’s going to be a long walk) through the most notable DAOs that have ever existed, are already running and are going to launch in the near future. While discussing DAOs, I will categorise them in terms of 3 main properties:

- Nature of the decisions to be made

- Incentives for participation

- Level of decentralisation

Along the way, I will also discuss my opinions about the DAOs, as well as any concerns I have for any of the mechanisms.

Before going on further, it’s necessary to state my definition of a DAO first: to me, a DAO is an organization that is run by people coordinating with each other via a trustless protocol, to make collective decisions for a certain cause.

With that, let’s jump straight into what I believe to be the first DAO ever:

Bitcoin — The Original DAO

Yes, that’s right. Bitcoin was the first DAO ever, at least in my definition. Essentially, its an organisation run by miners and full nodes, coordinating with each other via the Bitcoin protocol, to make collective decisions on what transactions are included and what their order is in the main chain of the Bitcoin blockchain. The cause for this organisation is simple: to secure the Bitcoin network and facilitate transactions on it.

The decisions to be made by the “Bitcoin DAO” are on the relatively low level of the blockchain infrastructure, on the blocks and transactions of the blockchain itself. We could then say that most other blockchains, like Ethereum or Zcash, are essentially DAOs as well. In this article, however, I will mostly talk about DAOs that exist on top of a blockchain, which have more defined purposes. I will call them “meaningful DAOs”. These “meaningful DAOs” inherit the decentralised and trustless properties of their underlying blockchain protocol, and build additional logic on top to serve more “meaningful” purposes.

The incentives for participating in the “Bitcoin DAO”, are mainly the mining rewards. If a miner behaves correctly and diligently produces valid blocks, it gets mining rewards for participating and contributing to the “Bitcoin DAO”. In my opinion, the incentives for participating in a DAO is key to its success. Rationally, participants would only actively contribute to a DAO if they are adequately incentivised to do so. Bitcoin has demonstrated how this simple concept has worked out so well. It’s worth to note that the incentives for contributing to the “Bitcoin DAO” are immediate. No delay, instant gratification.

Bitcoin has a high level of decentralisation. The protocol itself is fully decentralised. It can operate as long as there are participants in the network. In practice, however, we can’t say that it’s fully decentralised. At the time of writing, the top 4 mining pools have more than 50% of the hash rate, which means they could collude and perform a 51% attack to stop specific transactions or reverse their own transactions to double spend. There is also centralisation in the way new upgrades to the Bitcoin protocol are controlled by a few parties.

It might already be obvious to some, but it’s hard to achieve a 100% decentralisation level in practice. Even if the power to create blocks is somehow made highly decentralised, or if protocol upgrades are done via a highly decentralised voting mechanism, security vulnerabilities in the major clients/operating systems, among other things, could still seriously harm the network. As with all other things, reality can never be as perfect as in theory, since assumptions don’t hold. Taking a step back, should we even strive for full decentralisation? That is another whole discussion which I will talk more about in a later section.

Regardless, Bitcoin is still one of the most beautiful things that have happened to humankind. Since the days we all lived in tribes coordinating based on familial trust, humankind has come up with so many concepts and built so many complex systems to try to coordinate among ourselves. However, Bitcoin has given birth to an entirely new way of coordinating among ourselves, where the rules are written and enforced by immutable logic. Bitcoin was the father/mother of all DAOs.

DashDAO — The First “Meaningful” DAO

Originally a fork of Bitcoin, Dash (which was initially called Xcoin and then Darkcoin) went on to introduce an additional DAO element on top of its core blockchain protocol in August 2015: 10% of the block rewards go into a pool to fund proposals to grow the Dash network/ecosystem.

In this DashDAO, anyone can pay 5 Dash to create a proposal to ask for funding. Dash Masternodes (who need to lock at least 1000 Dash as collateral) vote to decide which proposals should or should not get the funding.

The decisions to be made in DashDAO are about how to allocate a pool of funding to real life proposals, to ultimately promote Dash adoption.

The incentive for Dash Masternodes to participate in DashDAO’s voting is the long term appreciation in value of their Dash stash, due to them voting for effective proposals and blocking lousy proposals (hence, save fundings for better proposals).

DashDAO has a high level of decentralisation. Anyone can join or leave as Dash Masternodes, and anyone can get their proposal passed as long as there are Dash Masternodes voting for it.

Being the first DAO that had explicit decision making on top of the blockchain consensus layer, DashDAO has been one of the most, if not the most, active and successful DAO. To date, hundreds of proposals have been passed in DashDAO, ranging from funding development efforts to marketing and community awareness efforts. At the time of writing, there are 31 active proposals up for voting for the next funding release of 5735.52 Dash for May 2019 (You can check them here). Powered by DashDAO, Dash has built a great ecosystem with active communities in multiple countries and payment support in multiple types of services like VPN, mobile top-ups, or even for buying fried chickens!

The DAO — The Infamous DAO

The DAO was one of the most exciting projects in blockchain so far. Started in May 2016, it attempted to create a totally new decentralised business model, where the organisation — The DAO — was collectively run on smart contracts by its token holders who contributed to its token sale. The token holders vote to give funding to proposals that were supposed to generate rewards back to The DAO. The DAO managed to gather a staggering amount of 12.7M Ethers, almost 14% of the Ether supply at the time.

The decisions to be made in The DAO were similar to DashDAO: how to allocate a pool of funding to real life proposals that would eventually give back returns to The DAO.

The incentive for The DAO participants to participate in its voting was the rewards from successful projects as well as the appreciation of their tokens’ value due to the tokens’ potential to generate more rewards. Admittedly, there were a few problems to The DAO’s incentive structure. Firstly, there were no guarantees how the projects funded by The DAO could eventually give rewards back to the token holders. Secondly, the funded projects would need to sell the Ethers for cash, which would temporarily lower the value of the Ethers that are backing The DAO’s token value. This second problem is shared with any DAOs where funds are given to proposals in terms of the tokens backing the financial interests of the DAO’s participants. There were also other problems with The DAO’s structure but that is outside the scope of this article.

The DAO was fairly decentralised. There were Curators who were to check the identity of the people submitting proposals and making sure that the proposals were legal before whitelisting their addresses. This process, as well as how the initial set of Curators was selected, was not entirely decentralised. However, people could be voted in and out of their Curator positions, and anyone who was not happy with the way The DAO was run can just split off from The DAO while retaining their share of the funds and rewards.

All in all, The DAO was an interesting and novel concept that should have been a cool experiment to witness, no matter how it ended. Unfortunately, it ended rather early and un-cooly, without us having witnessed much. There was a vulnerability in The DAO’s code leading to an infamous hack that most readers of this article should have been familiar with.

MakerDAO — The Administrative DAO

Launched on the Ethereum Mainnet on 17th Dec 2017, MakerDAO was created as a DAO to administer the running of its stable coin, Dai, whose value is stable relative to the US Dollar. Dais are generated by locking in some Ethers (or other assets in the future) into Collateralised Debt Positions (CDPs). More details about how Dai works can be read here. In short, the stability of Dai is maintained by a number of feedback mechanisms, implemented as a system of smart contracts on the blockchain.

The decisions to be made in MakerDAO are basically to adjust the configurations of the whole system and to trigger emergency shutdowns when necessary. The configurations to be decided on include parameters of the CDP types, what CDP types to add, as well as the set of Oracles for the Collateral Types’ price feeds, among others. The aforementioned emergency shutdown is a global settlement of the whole system, which should be triggered when there is a black swan event that threatens the proper functioning of the whole system.

The main incentive for the participants in MakerDAO — the MKR token holders — to participate in its governance process is the appreciation in value of the MKR token when the Dai Stablecoin System functions well and grows over time. In the Dai Stablecoin System, the CDP creators will have to pay a Stability Fees (or Dai Savings Rate when Multi-Collateral Dai is out) in MKR, which would be burned, indirectly increasing the value of MKR. Admittedly, this incentive mechanism is more of a long term process, which does not incentivise participation as much as how Bitcoin’s instant gratification does. Furthermore, there is a free-riding problem, whereby the lazy MKR token holders can still enjoy the full benefits of the appreciation in MKR value without having to spend any time or efforts in the governance process. This problem is prevalent in most DAOs.

On the flip side, there is a case for not having to incentivise voting that much. After all, having fewer informed and caring voters might be better than having more but less informed voters. This is another whole debate which is outside the scope of this article.

MakerDAO is fairly decentralised. In theory, all decisions in MakerDAO are done purely via MKR voting. However, MKR’s distribution is not the most decentralised. Moreover, it is hard to configure such a complex system purely via decentralised decision making. Many of the configuration changes, like the Stability Fees adjustments, need to be researched on and proposed by the Maker Foundation. It might be too crazy if everyone can freely choose all config values and the result would be the weighted averages.

That brings us to an opinion that has been raised by Vitalik, among others: fully decentralised, tightly coupled on-chain governance is overrated. The current human coordination mechanisms have evolved, via our cultures, through hundreds of thousands of years. Compared to that, the new way for decentralised human coordination via blockchain technology and DAOs is not even a new-born. Even though DAOs and decentralised voting are exciting breakthroughs, I think it might be too early to just rely on them 100% right away. A combination of on-chain voting, informal off-chain consensus and the core development team’s inputs might be more ideal, at least for now.

Aragon DAOs — The Plug-And-Play DAOs

Aragon: we heard DAOs are cool, so we made a framework for everyone to create their own DAOs in a few clicks.

Thanks to Aragon, you can now create a simple DAO easily in just a few steps. In such an Aragon DAO, you can assign stakes to a set of initial members, vote on stakes for new members, vote to release funds from your DAO, or just have a non-binding vote on anything.

For each of those Aragon DAOs, you are free to define the purpose of your own DAO, the types of decisions to be made and the incentives to participate in your DAO. It could be used to run a non-profit organisation, or as a way to manage family spending with your partner, or could just be your own personal DAO. The level of decentralisation is also up to how you set up your Aragon DAO. You can head over to this website to explore all the current Aragon DAOs out there.

*Disclaimer: I am a Digix employee and was majorly involved in the design and implementation of DigixDAO. However, I have tried my best to remain unbiased throughout this article.

DigixDAO — The Golden DAO

DigixDAO’s purpose is to push for the adoption of DGX — the Digix Gold Token that is backed 1-to-1 by 99.99% gold. There are currently 395000 Ethers in DigixDAO, that would be used to fund projects to grow the DGX ecosystem.

The decisions to be made in DigixDAO are similar to DashDAO: how to allocate a pool of funding to real-life projects, to promote DGX adoption.

The incentive for participating in DigixDAO is a little different from other DAOs: DigixDAO participants, who hold DGD tokens, receive rewards every quarter from the DGX fees that come from DGX adoption. These rewards are not only based on how much DGDs you have but also how active you are in contributing to DigixDAO, by either voting or executing projects. As such, there is relatively more immediate gratification for participating, as well as a disincentive to be an inactive DGD holder who does not contribute to the governance process.

DigixDAO is definitely not among the most decentralised DAOs. Proposers would have to pass a Know-Your-Customer (KYC) check by the Digix team. The Digix team can also stop certain projects’ funding due to policy, regulatory or legal reasons. One could say that by operating a blockchain gold product, Digix and DigixDAO have one foot in the real world that needs more centralised processes.

At the time of writing, DigixDAO has just launched on Ethereum Mainnet on 30th March 2019, and there is already 29.1% of the total supply of DGDs that was locked in its contracts to participate in the first quarter. You can find out more about the details in the DigixDAO’s guide, or head over to the DigixDAO Governance Platform to check it out.

MolochDAO — The Incentive Aligning DAO

Launched in Feb 2019, MolochDAO was born as an attempt to tackle the prevalent Moloch problem — which happens when individual incentives are misaligned with globally optimal outcomes. The immediate example that MolochDAO is targeting to solve is the state of Eth 2.0 development nowadays: while some people spend much cost and efforts contributing to Eth 2.0, the benefits of their work are disproportionately shared with all the other projects, who did not have to contribute to the infrastructure development at all. The rational behaviour would then be not to contribute to the infrastructure, which is globally suboptimal.

In MolochDAO, new members need to contribute Ethers into a funding pool to join and receive a proportional amount of stakes. These stakes are used to vote on proposals that are supposed to further MolochDAO’s cause and should increase its value.

There are two types of decisions to be made in MolochDAO: firstly, who to accept into the guild. This is to better align new entrants’ interests with the guild. Secondly, how to allocate new stakes (which essentially dilute the pool of stakes) to proposals that should increase the value of the whole guild.

MolochDAO’s members can liquidate their stakes anytime to get back the proportional amount of funds from the guild. As such, participants are incentivised to either increase the value of the guild by giving fundings to good proposals or to increase their amount of stakes by executing proposals themselves. For example, a proposal asking for 1% of the guild’s value to upgrade the core infrastructure, which people believe would increase Ether’s value by more than 1%, should always receive the funding. Admittedly, the people outside of MolochDAO are still free-riding these infrastructure upgrades. However, a neat thing is that: to the big Ether whales, he/she might do better by contributing his/her idle Ethers to MolochDAO and help to fund the infrastructure upgrades themselves, which might increase their net Ether’s value significantly more. Instead of complaining about the direction and the speed of blockchain development, it might be better to take matters into your own hands, if you want your Ether stash to grow in value. Anyway, that is only in theory. It will be fun to see how MolochDAO will be like in practice.

MolochDAO is not too decentralised in the way it bootstraps the first members and restricts access to new members. At the start, the upgrades are planned to be mostly via “rage-quitting” the old DAO and redeploying new contracts to replace it. These off-chain and centralised mechanisms are features, not flaws, as claimed in the MolochDAO white paper.

DAO Stack And Holographic Consensus

This section is about DAO Stack, a framework for creating DAOs, and the concept of holographic consensus introduced by DAO Stack.

The first DAOs built using DAO Stack would include Genesis DAO, created by DAO Stack themselves; DxDAO, created by Gnosis; and PolkaDAO, which is to fund community projects for Polkadot. When launched, all these DAOs would be accessible via Alchemy, a UI framework for DAOs using the DAO Stack.

For the sake of discussion, let’s talk about a SampleDAO that is created using the DAO Stack. There would be two main tokens in the working of SampleDAO: a non-transferable Reputation, and the Predictor Token. Reputation would be used as stakes to vote for proposals in SampleDAO. There can be proposals to upgrade the logic of SampleDAO itself, making it a self-evolving DAO.

Now comes the problem that DaoStack’s holographic consensus is trying to solve: as SampleDAO grows into a big DAO, there would be too many proposals to keep track of. The DAO’s attention should only be spent on the more deserving proposals, not the spammy ones. To summarise DAO Stack’s holographic consensus: people can stake some Predictor Tokens to a certain project A if they think A will likely get passed. If A gets enough Predictor Tokens, it will get boosted into a pool where more people would pay attention to it and the voters’ turnout required for passing will be relaxed. If A really passes, the people who staked Predictor Tokens for A will get back some rewards in terms of Predictor Tokens and Reputation. As such, there is a prediction market that will incentivise people to filter better proposals to be boosted. These boosted proposals would deserve voters’ attention more.

This seems like a neat way to solve the scalability versus resilience problem. Moreover, DAO Stack envisions that the different DAOs that employ its framework will use the same Predictor Tokens GEN, which is created by DAO Stack themselves. This will create a network of “predictors” who will go around the different DAOs and help filter the better proposals.

After reading about DAO Stack, my first concern is that: a person X who staked for a proposal A would just vote Yes for A, regardless if A is good as a proposal or not, since X wants the rewards for predicting correctly.

The second concern is: what kind of incentives could there be for the Reputation holders to vote for the projects that are boosted? If they are not incentivised sufficiently, the only active voters might turn out to be the Stakers themselves, due to the first concern. I will talk about this more in DxDAO.

The third concern is: since “predicting correctly” is defined only by the voting result, predictors might be more concerned about the popular opinions regarding the proposals, more than the actual quality of the proposal. It could be like: “Oh I know proposal B is a bad one, but I also think that it is popular, so nevermind I would just stake for it, and also vote for it since I already stake for it”.

I get that these concerns are not breaking and that having perfect mechanisms are hard, if not impossible. Or perhaps I might have missed out something in my research, in which case I would be happy to hear the answers to these concerns.

DxDAO — The Anarchist DAO

DxDAO, which will be launching in April 2019, is created by Gnosis using DAO Stack, to be a fully decentralised DAO. Gnosis will step back and not retain any kind of control or pre-minted assets in DxDAO after its deployment. All is fair and square.

The initial purpose of DxDAO is to govern the DutchX protocol’s parameters. DutchX is a novel and fully decentralised trading protocol using the Dutch Auction principle. By trading on DutchX, you will get Reputation in DxDAO. Reputation is basically the stake that will be used to vote in DxDAO. You can get Reputation by locking Ethers or other ERC20 tokens traded on DutchX.

Although governing over the DutchX protocol is DxDAO’s initial purpose, DxDAO can literally evolve to anything possible on the Ethereum blockchain, since its participants can vote to upgrade the logic in DxDAO itself.

The incentive for participation in DxDAO is to get more Reputation. However, I have not been able to find a good link between the success of the DutchX protocol and the value of DxDAO’s Reputation. This is basically my second concern in the section about DAO Stack. It is true that the predictors are well incentivised to stake GENs and filter proposals. However, if there is little correlation between the value of Reputation sitting in the voters’ accounts and the success of the DutchX’s protocol, the only ones who are incentivised to vote might just be the predictors themselves, who would just vote for the proposals that they staked. Again, I would be happy to find out that I have not done my research well and missed out something here.

As for the level of decentralisation, DxDAO is clearly highly decentralised on the spectrum. Anyone can participate, and no-one has special power over it.

DutchX would be one of the most, if not the most notable DAO using DAO Stack’s framework, with the holographic consensus mechanism. It is a new concept and it would be interesting to watch how this “anarchist DAO” will turn out to be. As Gnosis has put it:

“The dxDAO will either develop its own life and identity independently of Gnosis — or perish.” — Gnosis

Polkadot — The meta-protocol DAO

As with Bitcoin, most blockchains are already DAOs, making decisions on the blocks and transactions level. However, the blockchain protocol mostly stays the same. If the protocol was to be changed, it will be via off-chain and the traditional methods of human coordination (for example, via opinion leaders debating and gaining support from the community).

Polkadot takes it to another level, by moving the protocol upgrade mechanisms on-chain. This means that the stakeholders in Polkadot can decide on hard-forks via on-chain voting, which could smoothly evolve Polkadot to anything possible with a protocol upgrade. Hence, Polkadot could be said to be a meta-protocol — a protocol for changing its own protocol.

Decisions in Polkadot are made via referenda, which could be submitted publicly or by the “council”. The council consists of a number of seats that are continuously added or removed via an election process. The council can propose referenda as well as stopping malicious or dangerous referenda. Ultimately, a referendum must pass a stake-based vote before its proposed changes are executed.

The incentive for the stakeholders to participate in the “Polkadot DAO”, or the governance process of Polkadot, is the appreciation of their stakes (the Dot tokens) due to a successful Polkadot network.

Polkadot clearly has a high level of decentralisation. Well, even the hard-forks are decided by an on-chain vote. Admittedly, the initial selection of the council might not be completely decentralised, which is necessary as many might agree. However, the mechanism of rotating the council’s seats should diffuse these bits of centralisation over time, at least in theory.

Polkadot would be one of the most notable, if not the most notable blockchain that is implementing on-chain governance for protocol upgrades. It would be fun to see what Polkadot would upgrade to. As Gavin has said, he would like to see Polkadot evolve as an entity by itself, which is a powerful concept that might change society and the way humans coordinate in the future.

Final Remarks

With the launch of Polkadot, MolochDAO, DigixDAO, GenesisDAO, DxDAO, WBTC DAO, and PolkaDAO, among others, 2019 could be said to be the year of the DAOs. It’s great to see a variety of different concepts among these newcomers to the world of DAOs. In practice, some of these concepts might work, some might not. Regardless, it will be exciting to witness the early experimentations on the new ways of human coordination through DAOs. Let’s buckle up, it’s gonna be a fun ride. For all you know, we might be catching a glimpse of what human organisations will evolve to in the future.

Do reach out to me via Twitter if you want to discuss further (especially if I wrote something wrong).

Follow me on Twitter if you want to see more content. I did have more to say in certain parts but did not want to make the article too long.

The State Of The DAOs was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Hacker Noon https://hackernoon.com/the-state-of-the-daos-b7cba318460b?source=rss—-3a8144eabfe3—4