The ripple effect emanating from the 2008 global financial crisis continues to be felt in 2019. A decade on, 66% of British people say they do not trust financial institutions to work in the best interests of UK society, according to YouGov Omnibus research carried out last year.

Fear persists to the point that 63% of respondents are worried the banks could cause another financial crisis.

Just as trust in traditional banking has broken down, the fintech revolution has revved up several gears as consumers embrace the chance to manage money at their fingertips.

Over the past 12 months, 32% of people have used a banking app to make a mobile payment or transfer money, rising to 48% among those aged 15 to 34, according to Ipsos Mori data. Some 11% of those surveyed have used an app from an online-only or mobile-only bank.

This wider shift to managing money online has fuelled a desire for clarity and transparency in payments and investments. No longer closed off and opaque, these sectors are being opened up by digital players focused on transparency and prioritising customer choice.

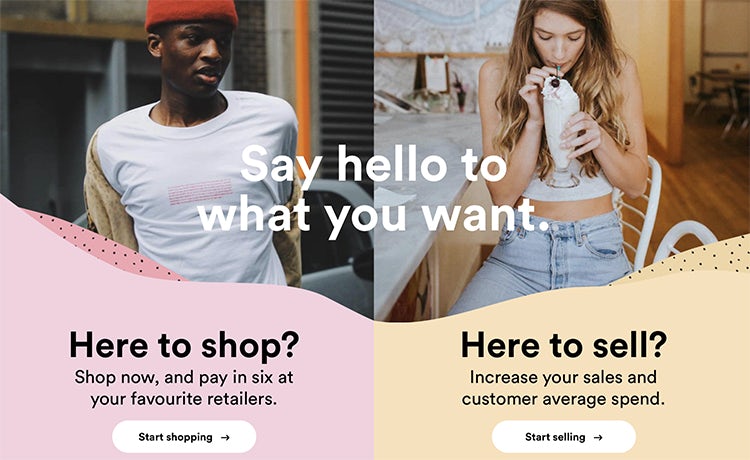

This approach resonates with millennial and Gen Z consumers, because they do not care about the old ways of doing things, insists Gary Rohloff, co-founder and managing director of payment platform Laybuy. He argues the millennial market in particular has shifted away from credit cards after seeing what debt did to people during the recession.

We ask ourselves, would a bank do this? And if the answer is yes, we don’t do it.

David Sandström, Klarna

“The global financial crisis shook the world and there’s still a hangover. Young people who have lived through that are very sceptical about the whole finance sector as a result,” Rohloff states.

“Plus, we’re all busy and we want control over what’s happening with our money, because it’s hard won and if I’m having to pay people for stuff I don’t really understand that gets me into trouble. It’s just not right.”

This is the premise behind Laybuy, an interest free payments platform which spreads the cost of purchases online or in-store across six instalments. The consumer pays the first instalment upfront and then can choose which day of the week they want the subsequent five payments to come out of their account over the remaining weeks.

Based on the internal strapline ‘making the desirable affordable responsibly’, Laybuy has been designed with transparency at its heart. Consumers, for example, receive a notification saying the payment will be coming out of their account the day before the due date. If the payment is missed they have a 24-hour grace period to make the payment, otherwise their Laybuy account is suspended and a £6 late payment fee incurred.

While the priority is improving the experience for shoppers, Rohloff, who has 18 years’ experience as a retail CEO, hopes Laybuy will also cut waste within the supply chain and help retailers move away from an aggressive discounting culture by making full price products attainable for consumers.

Launched in Rohloff’s native New Zealand in May 2017, the family-run business is currently being offered by 4,500 merchants across Australasia to more than 500,000 consumers. Officially rolled out to the UK in March, Laybuy now has 320 merchants signed up, including footwear retailer Footasylum.

While retailers pay an average 4% commission, Rohloff believes this is a fair trade-off given that offering Laybuy drives average order values by 60%, online and in-store conversion rates typically increase by 50% and retailers experience a 30% rise in customer acquisitions.

Attack the category

Gaining greater clarity over finances in a way that fits modern life is a global trend, according to David Sandström, CMO of payments provider Klarna. He argues that historically the power lay within the old banking structures, but the banks have failed to keep up with the “complete digitisation” of people’s lives.

“The old banks want to keep the power with them, keep the data with them and I don’t think consumers are having that anymore,” says Sandström.

“Why in a digitalised world would a consumer want to pay up front for a thing they haven’t seen and don’t know the real quality of? Why would they take the risk of all the logistics and potential hassle of returning stuff in a digitalised world? Why would a consumer be that disempowered?”

Working with high street retailers such as Topshop and Asos, Klarna offers consumers a variety of payment options. They can choose to pay later, which gives them 30 days to pay for their online order, pay in three equal interest-free instalments, or opt to ‘slice’ the cost of the payment from six months to 36-month payments.

Klarna says it is focused on improving the “post-purchase experience” and replicating the fun of shopping, which Sandström argues banks and other fintechs fail to do because they operate on a “different wavelength” to their consumers.

“We ask ourselves, would a bank do this? And if the answer is yes, we don’t do it. This is all about not acting like a stiff, old bank, but actually attacking the category in a completely new way,” Sandström states.

He explains that communities and subcultures are the most important part of Klarna’s media mix. The ‘Get Smooth’ campaign in January, celebrating US rapper Snoop Dogg securing a minority stake in Klarna, was all about engaging different communities. So while Snoop’s name change to ‘Smooth Dogg’ was directed at the Hip Hop community, the news about the investment resonated with the financial community.

The tie-up with Snoop generated “many hundred million impressions” for Klarna and Sandström is proud of the fact this partnership has longevity as he is an investor and not just an influencer who will disappear once the campaign is over.

Millennial market

While new services are offering consumers payment transparency and flexibility, a host of digital-only players are also shaking up the investment market.

The idea is that removing the high barriers to entry will encourage more people to invest and statistics show there is room for growth. Only 3% of consumers have used an app for tracking and managing investments, or trading stocks and shares, over the past 12 months, according to Ipsos Mori data.

Of this number, 4% were men and 1% women, while young people aged 15 to 34 were twice as likely (4%) to invest via an app compared to those aged 35 and over (2%).

Wealthify was founded to bring down these barriers to entry, such as high minimums and hidden fees. Investors can start with just £1 and are able to sign up within 10 minutes.

First, investors are asked to define their investment style according to five personality traits – cautious, tentative, confident, ambitious and adventurous. Using the ‘try this’ function, they can view what the projected value of their investment would be according to their risk profile. Investors can also opt for an ethical fund, which only invests in socially responsible companies. Users can then cash out at any time for no fee.

CMO Sally Allan explains that most people using Wealthify would never previously have got into investments due to the high minimums needed. Millennials aged 18 to 34 are the largest proportion of users, followed by the 35 to 54 age group.

There is often a pensions gap, because [women] take maternity leave, so we wanted to address that

Daniella Camilleri, Plum

Allen explains that while trust in financial institutions has been shaken, the digital migration of the investment sector has also been fuelled by the mass adoption of online banking. For Wealthify the key to success is simplifying the experience to appeal to first timers.

“Everything about it has been de-jargonised and simplified in order to give people that reassurance and help them to feel comfortable about what they’re doing ,” she states. “We want to be the most approachable and straightforward of the investment advice propositions.”

Fellow investment platform Nutmeg has seen the typical age of its investors dropping year-by-year as the appeal grows among people in their 20s and 30s.

“The early Nutmeg investors were older and probably slightly more traditional investors who thought this is interesting and new,” explains brand and customer marketing director, Grant Warnock.

“As we got the message out there, pushed it through digital channels to younger investors, we reached this whole new generation who were completely ready for something that looked like apps already on their phone.”

Warnock is aware that competition for digital wealth management is hotting up. He points to the fact there was an unprecedented amount of outdoor and tube advertising for digital investment products last tax year.

Nutmeg’s new campaign, released in March across outdoor, digital and TV, aims to cut through the noise by tapping into the feeling that in uncertain times it is easy to do nothing with your money, but that’s not always the best idea.

The TV campaign is performing well, having already achieved 55% brand awareness in London. Warnock believes TV is a great medium to reach a non-traditional investing audience who may not see the outdoor commuter media or perhaps are not located in the capital.

“If you believe you’ve got a message for quite a wide audience, which we do, then TV is still fantastic,” he adds. “Of course, all digital targeting and use of commuter media is really effective because it’s so intense, but you can’t equal TV if you really believe you’ve got a product with a wide audience.”

READ MORE: Monzo preps first major ad campaign as it looks to ‘supercharge’ growth

Passion points

The marketers at eTorro, a multi-asset platform for cryptocurrencies, stocks, indices and commodities, agree that barriers need to be broken down for a new generation to develop a passion for investing.

The very fact consumers are so invested in brands gives them an advantage as they understand which companies are resonating within their community, states UK head of marketing, Stephanie Wilks-Wiffen.

“As a consumer we’ve got our ear to the ground and we are more aware of what’s going to trend and be successful than analysts sitting in big corporations trying to work out what the next investment should be,” she explains.

“Millennials are only going to invest in brands and companies they believe in and trust, and so it’s about trying to find that synergy between people and investing in stocks, rather than seeing it as something that is quite opaque, boring and stale.”

Built on a community of 10 million users, in many cases millennials who joined after the cryptocurrency surge of early 2018, eToro enables first time investors to automatically copy the portfolio of successful traders. Investors can follow the success of their trades in real time and stop copying their chosen traders at any point.

To help build exposure nationwide, in August 2018 eToro splashed out on sponsorships of seven Premier League clubs – Tottenham Hotspur, Crystal Palace, Brighton, Leicester City, Newcastle United, Cardiff City and Southampton.

“We wanted to build brand awareness, but we paid for the sponsorship deal in Bitcoin as we wanted to start showing how crypto can be used to revolutionise different sectors, such as the Premier League,” Wilks-Wiffen explains.

READ MORE: Gimmick or game-changer? Behind the hype of Bitcoin and blockchain

Having built its reputation in the crypto-space, eToro’s latest outdoor campaign, ‘We’re not just about the C word’, is aimed at showing potential users that the platform offers more than just cryptocurrencies.

For fintech chatbot Plum, the focus of its latest campaign is to encourage more women to invest. Community and product marketing manager, Daniella Camilleri, believes perceptions need to shift to show not all investors are “Wolf of Wall Street-style men in suits”. This is important given women make up 60% of Plum’s wider user base, but only 40% of its investors.

“There is often a pensions gap, because [women] take maternity leave, and so we wanted to address that and show, if anything, investing is more appropriate for women than it is for men. But we didn’t want to do it in a patronising ‘pink-ified’ way,” says Camilleri.

The campaign shows women discussing their initial concerns, as well as the opportunities of being a first-time investor. To help further widen the investing pool, Plum offered men and women fee-free investments for a year if they posted #InvestwithPlum on social media before 6 April.

Six months on from launching its investment product, Plum has grown to 375,000 active users. Interested investors are encouraged to join Plum’s 15,000-strong Facebook community or engage with the Investment Academy, which outlines the basics of investing. Plum also routinely hosts socials so its members can catch up in real life.

Camilleri explains that creating a community helps people feel reassured that it is normal not to understand everything about investing from day one.

“Being a bit kinder to yourself and realising everyone could do with learning a bit more is really helpful, because it just removes all those barriers and helps people feel more confident,” she adds.

from Marketing Week https://www.marketingweek.com/2019/04/25/fintech-brands-democratising-payments-investments/